Summary

As the Covid-19 virus began to spread, shuttering businesses and upending economies, the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, saw opportunity in the recovery from the unraveling crisis. Georgieva had already identified income and wealth inequality as a central challenge facing the global economy. In her view, the pandemic brought both the risk that poverty and inequality would exponentially worsen and a “once in a lifetime opportunity” to invest in recoveries that transform economies to make them “greener, smarter, and fairer.”

In speeches, interviews, and opinion pieces, Georgieva laid out a strategy for how the IMF can help governments emerge from the pandemic with more inclusive, sustainable, and resilient economies, from modernizing tax systems to make them more progressive to investing more in health, education, and renewable energy, restructuring unsustainable debt, and building stronger social protection systems. This vision—what Georgieva called a “new Bretton Woods moment”—carves out a different approach to the one the Fund took following the 2008 Financial Recession and continues a significant evolution in how it sees its role in promoting global economic stability. Although in laying out this vision, Georgieva did not explicitly reference human rights, including the IMF’s human rights obligations, the Fund’s response to the crisis has monumental significance for hundreds of millions of people’s economic, social and cultural rights.

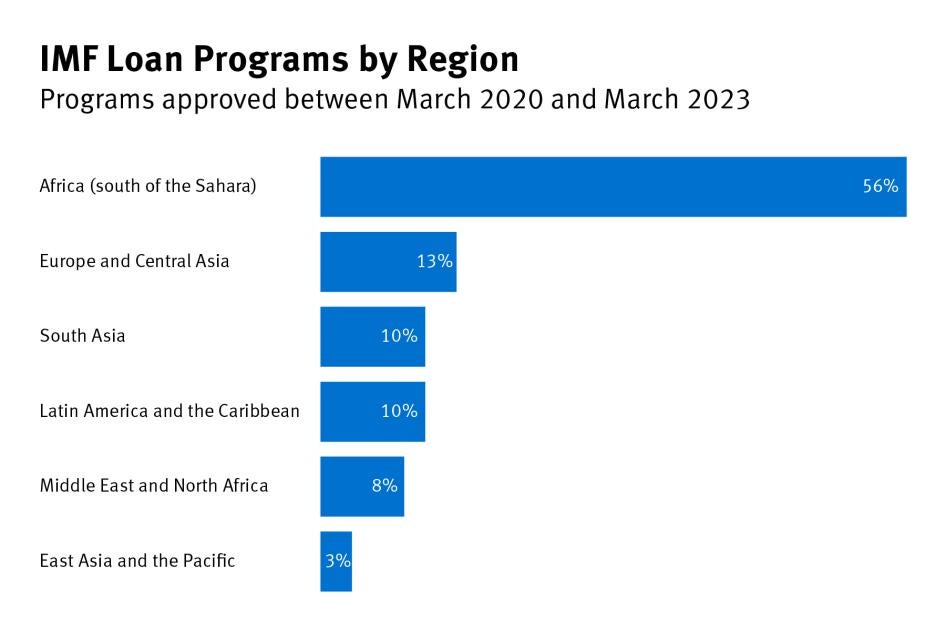

This report analyzes 39 IMF loan programs approved between March 2020, the official start of the Covid-19 pandemic, and March 2023 under three lending facilities that include conditionalities—the Extended Credit Facility (ECF), Extended Fund Facility (EFF), and Stand-By Arrangement (SBA)—to understand how the IMF is approaching the current crisis in practice and to assess the extent to which it aligns with international human rights standards. The total population in the countries affected by these programs is more than one billion people. The report also includes an in-depth case study of Jordan, where the government has been implementing a series of IMF programs since 2012, based on over 70 interviews and a review of relevant documents and data.

The report makes several key findings. First, it finds that the Fund continues to rely on its traditional approach of expecting governments to reduce debt through fiscal consolidation, which raises significant human rights concerns. While “fiscal consolidation” refers broadly to reducing debt by cutting public spending or increasing revenues, the report finds that programs routinely include conditionalities that impose cuts to public spending and raise the tax burden in ways that disproportionately burden people on low incomes, and they do not adequately explore alternative approaches that are more protective of rights. While many loan programs acknowledge likely harmful social impacts and the importance of “protecting the poor and vulnerable,” they do not generally include an analysis of these impacts, despite guidance in its social spending strategy to do so. Under international human rights law, governments and international financial institutions have an obligation to conduct thorough human rights impact assessments of loan programs prior to the provision of the loan and pursue policies based on the outcome of these assessments that best protect and progressively realize, rather than erode, people’s economic and social rights.

Second, the report finds that a central feature of the Fund’s efforts to address the social impact of its loan programs and build more inclusive economies is the establishment of “social spending floors.” These floors, which are distinct from International Labour Organization (ILO) social protection floors, described in more detail below, typically set a minimum amount a country is expected to spend on specified social programs and “social safety nets,” a term that the IMF and World Bank generally use to refer to tax-financed social assistance to “targeted poor and vulnerable people,” rather than rights-aligned social security programs. These floors serve multiple purposes, including protecting specified social programs from spending cuts as part of fiscal consolidation, as well as “mitigating” the social impact of program adjustments and improving countries’ social protection programs.

The Covid-19 pandemic cast a new light on the importance of social protection, as the reality that half the world’s population—some four billion people—are not covered by any form of social protection contributed to both a humanitarian and economic crisis as the virus shuttered businesses and wreaked havoc on livelihoods. Social protection is key to securing a range of human rights, including the right to social security. The United Nations defines social protection as a set of policies and programs aimed at preventing, protecting, and overcoming situations that adversely affect the well-being of people throughout the course of their lives. It encompasses a wide range of programs that provide support particularly in situations that affect people’s ability to earn an adequate income because of social and attitudinal barriers in conjunction with other conditions such as sickness, disability, older age, unemployment, and childrearing. Social protection systems include a mix of contributory schemes, referred to as social insurance, and tax-financed benefits, referred to as social assistance or sometimes as social safety nets.

While the Fund’s increased attention to social spending more broadly, and social protection in particular, are positive steps toward creating the fiscal space for governments to fulfill human rights, the report finds its approach of heavily relying on social spending floors and poverty-targeted cash transfer programs falls far short of fulfilling rights and can serve to obscure the harmful rights impacts of IMF programs.

The International Covenant on Economic, Social and Cultural Rights, ratified by 171 governments, enshrines all people’s rights to health, education, social security, housing, and an adequate standard of living, which includes food, among other rights. While the full realization of these rights is expected to be realized progressively, the covenant requires governments and international organizations to take immediate steps to facilitate their realization including through legislative and other measures, and to use “the maximum of their available resources,” including to provide and seek “international assistance and co-operation.” Failing to do so is a violation of international human rights law. Many IMF conditionalities, sometimes referred to as “adjustments,” demand changes to structural economic policies in ways that can undermine governments’ ability to realize these rights. In some cases, these adjustments can reshape fundamental aspects of the social contract; that is, in political theory, the theoretical tacit agreement between citizens and their government that underpins its legitimacy.

Existing social contracts have yielded explosive inequality and devastated the environment, so the IMF’s recent shift offers a critical opportunity for building new social contracts rooted in international human rights standards. While social protection is a key pillar of a rights-aligned social contract, it works alongside other pillars, such as quality public services and strong labor laws. However, IMF adjustments can erode these other pillars, such as by placing strict limits on public wages, leading to a retrogression of rights. Social spending floors should not substitute for an approach that pursues policies that avoids retrogression and best fulfills rights, including considering alternatives to austerity. Moreover, this report finds numerous gaps in how social spending floors are defined and designed that limit their effectiveness.

In a similar vein, it finds that the Fund’s focus on poverty-targeted cash transfer programs, often in partnership with the World Bank, is far too narrow to protect people’s right to social security. The Fund’s position is out of step with the growing number of international institutions and scholars that have recognized that universal social protection programs, which provide support to everyone in certain groups, are far better at ensuring that all people can access their rights when compared to means-tested programs, which target people based on socio-economic status, such as their income or assets. The World Bank has formally committed to promoting universal social protection, although in practice it is heavily investing in poverty-targeted programs, including in close collaboration with IMF programs.

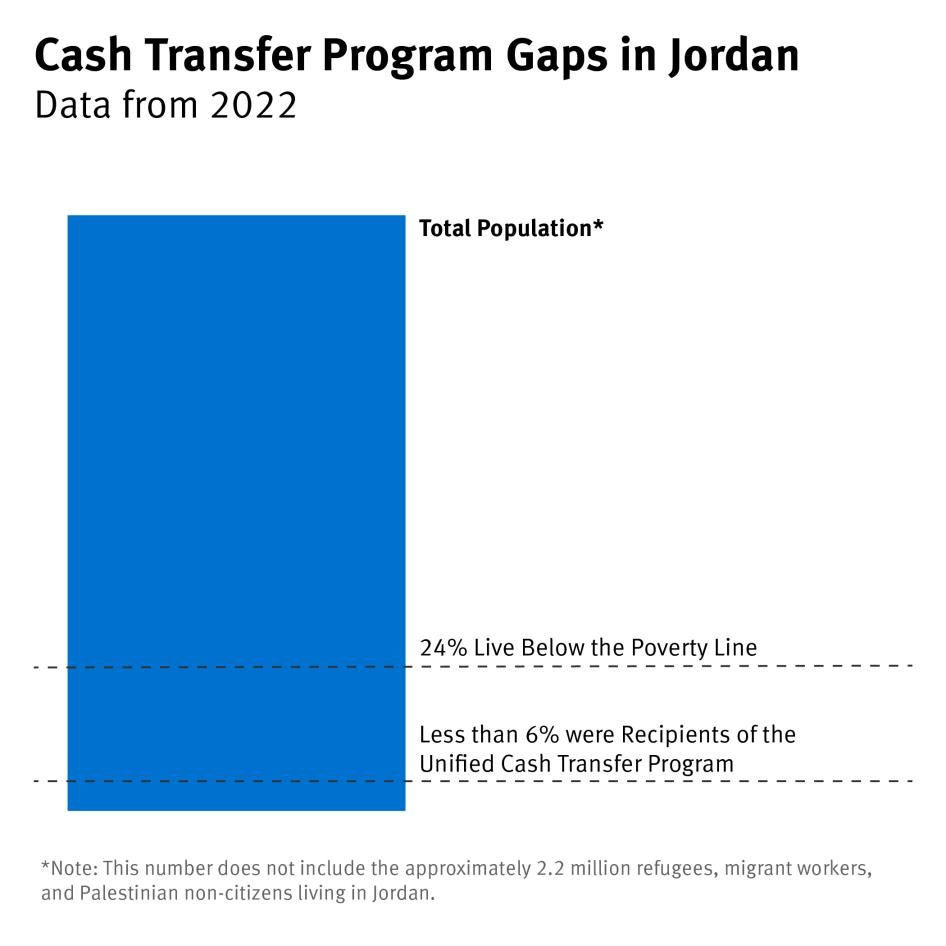

Jordan is illustrative of how the IMF’s current approach fails to meet the vision that Georgieva laid out at the beginning of the pandemic. Since 2012, the government has enacted sweeping economic reforms as part of a US$4.4 billion series of IMF programs that imposed austerity-driven measures that increased the cost of living. Recent programs included social spending floors that incorporate a new poverty-targeted cash transfer program, called Takaful, that the government established in 2019 with the support of the World Bank and the United Nations Children’s Fund (UNICEF), in part to offset these reforms (The program has since been renamed the Unified Cash Transfer Program). While the spending floor and Takaful were an improvement over the earlier programs, they are a bandage on a bullet wound. The reforms generated billions in savings and new revenues through measures that increased the cost of living, yet public spending on health, education, and social assistance did not increase as a percentage of the budget. The establishment of Takaful has served as an important lifeline, especially during the pandemic, but it covers only about one in five Jordanian families living under the poverty line, a measure which doesn’t fully capture the millions of people whose rights are affected by these reforms, including the large refugee population living in Jordan excluded from the program. To add salt on the wound, Jordan’s debt-to-GDP ratio is now higher than it was when the IMF approved the first program in this series a decade ago.

Protecting Human Rights Amid Economic Crises

Economic crises—and the responses to them—usually fall hardest on people on low incomes, and the global crisis triggered by the Covid-19 pandemic is no exception. The World Bank estimates that 97 million people had their incomes fall below the poverty line in 2020 alone, and the 2022 Global Report on Food Crises reported that a record 193 million people were experiencing food insecurity, an increase of 58 million people since 2019. At the same time, many governments have accumulated significant debt loads due to increased spending and falling revenues related to the pandemic, even as low- and middle-income countries face steep borrowing costs that impede their ability to recover. How the IMF and governments responded to the crisis can exacerbate the devastating impacts on people’s rights, or, conversely, address long-standing gaps that protect and improve the realization of rights.

Efforts to reduce debt by cutting public spending or raising regressive taxes—that is, austerity—can have well-documented harmful impacts on human rights. Recognizing this, international human rights law sets out strict parameters for when and how states may pursue austerity measures, including that they “demonstrate that all other alternatives have been exhausted, and provide safeguards to protect human rights, particularly the rights of the most vulnerable.” Austerity measures must also be temporary, necessary, proportionate, respectful of minimum core human rights obligations, and non-discriminatory. To ensure these conditions are met, governments and international financial institutions are expected to conduct human rights impact assessments that weigh the potential impacts of policy alternatives. These assessments should serve as the basis for a transparent and credible public dialogue that leads to pursuing the policy option most protective of rights and a plan to effectively safeguard rights when policies that are unavoidable present high risks of retrogression. Guidelines endorsed by the United Nations Human Rights Council advise that austerity is a prima facie violation of human rights unless these conditions are met.

Applied to IMF programs, staff should justify why policies included in specific programs are most likely to lead to the fulfillment of rights, such as by reducing poverty and inequality and enabling adequate spending on sectors essential to the realization of rights without discrimination. They should also undertake detailed assessments on the distributional impacts of program conditionalities and how governments are expected to safeguard rights from any harmful impacts. The IMF’s strategy on social spending adopted in 2019 provides an avenue for conducting such assessments by directing staff to “analyze and, as appropriate, document the social impact of adjustment and measures to protect the vulnerable.” Adjustments are structural economic reforms to which countries need to agree in order to secure an IMF loan. However, as described below, IMF loan programs largely lack such analysis and documentation. The IMF should publish these analyses prior to the approval of programs to facilitate an informed and meaningful dialogue with the public as part of loan negotiations.

Analysis of Loan Programs Approved March 2020 to March 2023

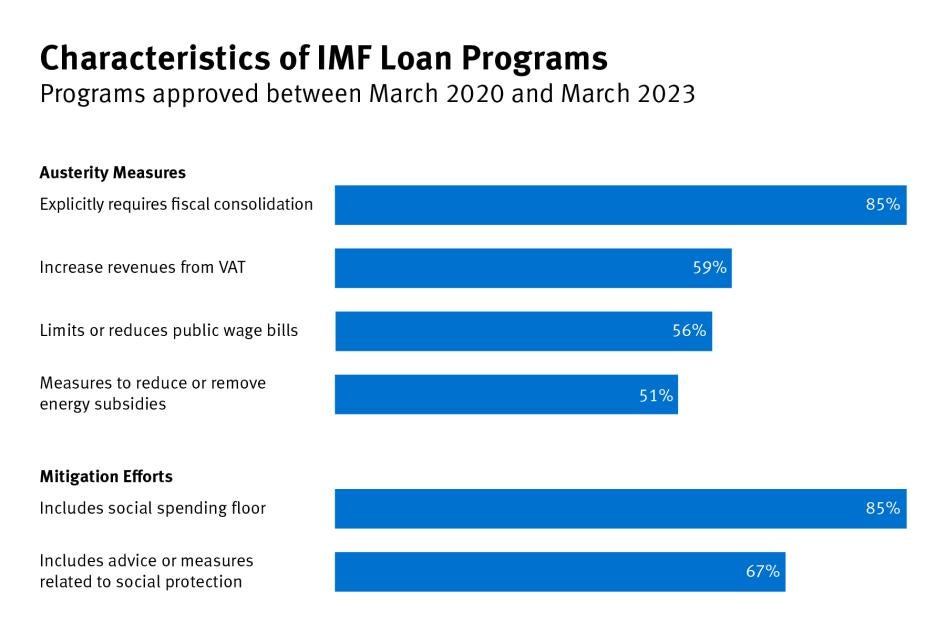

Between March 2020 and March 2023, the IMF approved 34 loans under the Extended Credit Facility (ECF) or Extended Fund Facility (EFF) arrangements and six under the Stand-By Arrangement (SBA). Programs under the ECF and EFF are typically three to five years long, while those under the SBA are generally one to three years long; all three lending facilities include conditionalities (This report’s analysis excludes a $15.6 billion program to Ukraine approved in March 2023 given the extenuating circumstances in the country). These programs vary in many respects, but most share a common theme: they preserve the IMF’s traditional approach while increasing the emphasis on “mitigation.” This approach is best captured by the phrase, a variation of which appears in most programs, “fiscal consolidation while protecting social spending.” All but six programs include a social spending floor.

Doubling Down on Austerity

Social spending floors need to be understood in the context of IMF programs, since one of the central functions they serve is to mitigate impacts of structural adjustments. Of the 39 loan programs reviewed, all but six are explicitly underpinned by “fiscal consolidation,” a term that refers to reducing government debt by reducing spending and/or raising revenues. Although it is possible to achieve fiscal consolidation solely through raising revenues in a progressive manner, in practice most programs reviewed rely in part on decreasing public spending as a percentage of the GDP; that is, austerity. Many common measures to reduce spending can have a directly harmful impact on rights, and many economists, including some within the IMF, argue that cutting spending during a crisis can exacerbate poverty and inequality. Efforts to increase revenue can also have harmful rights impact where they overly rely on regressive taxes. Taxes on goods and services, called “indirect taxes,” tend to be regressive. Those with lower incomes or wealth will often spend a bigger percentage of their income on such taxes than those with higher income or wealth.

Many programs make explicit reference to social spending floors as “mitigating” the impacts of program adjustments, but all but one lack detailed assessments of the impacts of these measures, making it impossible to assess whether they are effectively filling this role. In the Ecuador program, which replaced an earlier program that led to Indigenous-led public protests, IMF staff did conduct an analysis of the program measures’ impact by income decile, but even that analysis was missing key elements and surfaced several problems.

This report tracks three common policy measures included in the initial loan agreements: reductions in public wage bills; reducing or eliminating energy subsidies; and increasing revenues through value-added taxes (VAT). It finds 22 programs include structural benchmarks or general advice to lower the public wage bill, generally through freezing hires and capping or lowering salaries. Such reforms can harm governments’ capacity to fulfill their rights obligations by undermining their ability to deliver quality public services. While some programs explicitly exempt the health and education sectors from cuts or caps, few exempt other sectors essential to rights, such as water and sanitation, environmental agencies, and public transportation. Particularly in the context of high inflation, it can also effectively reduce salaries for public sector employees. Reductions in public sector jobs or salaries also disproportionately hurt women both because they are more likely to fill the gap when public social services are absent and because women tend to be overrepresented in public sector jobs.

Twenty programs remove or reduce consumption-based subsidies on fuel or electricity or develop plans to do so. Fossil fuel subsidies direct enormous amounts of public resources to propping up an industry that drives the climate crisis and harms people’s health and the environment; phasing them out is crucial for avoiding the worst impacts of climate change, reducing the burden on government budgets, combatting inequality, and transitioning to renewable energy sources. However, it is critical that fossil fuel subsidy reform is undertaken in concert with other measures, such as adequate investment in social protection and renewables. The wealthy disproportionately capture the benefits of energy subsidies because they consume more, but without adequate protection measures the impact of removing or reducing consumption-based subsidies is felt most acutely by people on low incomes as it forces them to pay a higher share of their income for transport and goods and services that are tied to energy prices and that they must access to realize their rights.

Twenty-three of the reviewed programs include measures to increase VAT rates, remove exemptions, or otherwise increase VAT revenues. Value-added taxes, which are an indirect tax, tend to be regressive since they are the same for people regardless of income. For example, the Sri Lanka program increased VATs from 8 to 15 percent and the Zambia program removed VAT exemptions on most unprocessed foods. Some IMF and other publications have argued that VATs are not regressive because the wealthy pay a greater share of the total revenue collected because they consume more, but the tax consumes a higher share of low-income families’ income, and in some cases, it can make food and other goods essential to rights no longer accessible to them. A study of VATs in France found that the poorest households pay more than 20 percent of their income in consumption taxes, compared to less than 10 percent for the wealthiest households. In many countries, VAT is applied to menstrual health products, which can impede girls from attending school, among other rights harms.

This report’s analysis is largely limited to IMF documents and, with the exception of Jordan, it does not investigate the on-the-ground impact of the programs reviewed; in some cases, governments may not have implemented conditionalities as they appear in program documents. This report does not track other policy measures that can harm the rights of people on low incomes and that can be found in some programs, such as pension reform, labor flexibilization, and exchange rate reforms. At the same time, some include positive reforms for the realization of rights, such as those related to anti-corruption and progressive revenue generation, that are also beyond the scope of this report.

The False Promise of IMF Social Spending Floors

In the context of IMF programs, social spending floors fill multiple functions. They are variously described as intended to protect social sectors from cuts, mitigate impacts of structural adjustments, and develop countries’ social protection programs. Yet nearly all loan programs lack adequate information to properly assess the practical implications of these floors, which undermines the public’s access to information crucial to a meaningful debate about these measures and its ability to meaningfully engage with their government and the IMF to ensure that loan programs protect their rights. For example, most programs do not include baseline information on social spending levels prior to IMF loan programs, making it difficult if not impossible to assess whether and to what extent the floors will lead to an overall increase in social spending. The way in which social spending floors are defined also often makes it difficult to assess which social programs, if any, will benefit from an increase in spending. While adequate spending is not in itself sufficient to guarantee the fulfillment of rights, it is nonetheless necessary.

In many cases the floors are defined to cover broad categories of spending that go far beyond social protection, and encompass spending on health, education, and other social sectors. This is important for protecting as many social programs as possible from potential spending cuts, but it does not alone ensure that people’s rights are safeguarded from the impacts of adjustment, nor does it guarantee investment in improving social protection. For example, Benin’s program defines the floor as covering 72 enumerated programs across 12 sectors, including “integrated management of border areas” and “development of rural roads.” While defining the floor so broadly serves an important purpose of protecting numerous areas of social spending, even if there is an increase in total spending on these areas, it does not necessarily compensate for the impact of adjustments in the program. In Benin, for example, these include removing VAT exemptions for imported rice, water, and electricity, even as one in three children under five suffer from chronic malnutrition, according to the World Food Programme.

To address this problem, the IMF should adopt separate floors to serve distinct purposes: one for protecting and increasing spending in areas critical for fulfilling social and economic rights without discrimination, and another for mitigating against necessary measures that nonetheless pose risk to rights, such as phasing out fossil subsidies. The first should be broadly defined, and disaggregated by sector, and ensure that spending on, for example, health, education, and social protection are, at a minimum, in line with international benchmarks as a percentage of GDP and of national budgets. The second should be based on published assessments of program impacts and demonstrate how the target, such as increased social protection spending or coverage, adequately mitigates those impacts to avoid, at a minimum, the retrogression of rights. For both, the IMF should consider replacing “floors,” which are revised in each review, with “goals” to be achieved by the end of the program, and a plan developed from the outset to achieve specific benchmarks in each review.

Moreover, in most cases, it is not possible to assess whether, or to what extent, the floor increases spending relative to previous years. Where floor definitions track budget lines, it may be possible to independently calculate this, but many floors include categories that aren’t tracked in public budgets. For example, Jordan’s floor covers “non-wage health and education current expenditures,” a category not specifically tracked in the budget, making it difficult to compare the amount provided for in the floor to spending prior to the program. All social spending floors should include baseline information to assess any increase in spending reflected in social spending floors.

Despite the challenges of assessing social spending floors, available information indicates three key problems. First, the IMF’s preference for poverty-targeted—also known as means-tested—cash transfer programs likely leads to setting floors too low to protect rights. Second, inadequate attention is paid to sequencing increases in social protection coverage to take place prior to the impact of adjustments. And finally, almost all social spending floors are incorporated as indicative targets, rather than “performance criteria,” the IMF term for requirements that require a Board waiver if not met, enabling the IMF to release additional funds even if government spending does not meet the floors. An analysis by Oxfam of 17 IMF loans approved in 2020 and 2021 found that around one-third of social spending floors were not met.

The Fund is increasingly turning to poverty-targeted cash transfer programs, frequently incorporated into social spending floors, including to address the social impact of its programs. Of the 39 programs reviewed, 26 referenced social protection, usually as structural benchmarks or as part of social spending floors; in nearly all cases, measures and advice were explicitly for targeted programs. These programs frequently replace other types of public programs meant to provide people with support, essentially reshaping existing social contracts. In some cases, improvements to tax-financed social protection schemes came alongside measures that could erode contributory schemes. For example, in Jordan, where the social protection floor incorporates spending on a new poverty targeted cash transfer program, the program also includes measures to exempt certain employers to reduce social security payments for certain employees. In other cases, such as subsidies on fuel or electricity, removing or reducing existing programs is necessary to shift toward a more inclusive and sustainable social contract, but it is critical that these subsidies be replaced by new programs that advance rights and enable a rapid transition to renewable sources of power transportation and electricity for all. However, the IMF’s persistent preference for targeted programs powerfully shapes and limits the role of social protection in evolving social contracts.

Research has shown that poverty-targeted programs have numerous flaws that can seriously hamper governments’ ability to guarantee rights, including from retrogression due to IMF-driven reforms. These include high rates of inaccuracy both due to including those who are not eligible and excluding those who are; bureaucratic and other hurdles to access; the expense of targeting programs; breeding social resentment that undermines support; and being more prone to corruption. Moreover, while these programs often set a goal of covering those living under the poverty line, they often cover only a portion of that group, such as in Jordan and Egypt. But even where they do cover all households under the poverty line, as IMF advice often emphasizes, it is still problematic because these lines are often set so low that they exclude many who are unable to realize their rights, particularly in the context of economic crisis and IMF-driven adjustments. Recognizing some of these problems, recent IMF guidance on social safety nets advises that in countries with limited data, rather than focusing on targeting the benefits, staff should look to “enhance tax capacity and effort” to “claw back” some of the benefits that accrue to high-income households.

In 2008, the body of human rights experts charged with interpreting the ICESCR issued a General Comment noting that “all persons should be covered by the social security system,” which it states necessitates the establishment of non-contributory schemes “in order to achieve universal coverage.” ILO Social Protection Floors Recommendation No. 202, approved by all member countries in 2012, calls on member states to establish and fund social protection floors that extend social security to all. Based on the principle of universality, the floor guarantees access to health care and provides basic income security for children; those unable to work due to social and attitudinal barriers in conjunction with sickness, disability, older age, or unemployment. As noted, the World Bank formally embraced universal social protection in 2016, although in practice it continues to support targeted programs.

The IMF’s program in Ecuador offers a clear example of the problem with the IMF’s preference for targeting safety nets only to those living under the poverty line, as well as inadequate attention to sequencing and enforcement. In addition to including an analysis of the impact of reforms by income decile, Ecuador’s program is unusual in that its floor is defined not as a minimum amount of spending but as a coverage target: the expansion of cash transfers to at least 80 percent of the poorest 30 percent of the population. These unusual features are likely due to public protests in 2019, led by Indigenous groups, opposing a previous IMF program that had sought to remove fuel subsidies without appropriate measures to mitigate its impacts on people on low incomes, among other measures. The subsequent program approved in 2020 included similar measures but with an explicit effort to assess and compensate for costs by expanding the social safety net as part of a World Bank-funded project. Ultimately, some of the measures anticipated by analysis IMF staff conducted were not fully implemented, but the program nonetheless offers a rare opportunity to examine how Fund staff approach social impacts.

The IMF’s analysis calculated that Ecuadorians who did not receive additional cash assistance would experience an effective net decrease in their income due to reforms mandated in the program ranging from 2.1 to 6.3 percent. The target of expanding the social safety net to the poorest 30 percent of the population was set to roughly align with the percentage of the population living under the poverty line prior to the pandemic. However, the pandemic temporarily pushed around 1.5 million people into poverty, increasing the number of people living under the poverty line to 38 percent of the population instead of 30 percent. This means that even if coverage had been immediately expanded in line with IMF expectations, it would have left out roughly 2.5 million people experiencing poverty at a time of economic crisis and rising prices. But coverage was not expanded immediately, and in fact took longer than expected to reach the targets the IMF program set. The government faced challenges in reaching particularly the poorest Ecuadorians; an IMF program review found that by October 2021 it had achieved only 30 percent coverage of the poorest 10 percent. In June 2022, Indigenous-led protests once again broke out to demand economic reforms, including in response to fuel subsidy removal imposed by the IMF. The protests, which forced the government to temporarily relocate to a city outside the capital, ultimately led the government to restore some subsidies.

IMF in Jordan: “I’m Dying of Hunger and I’m Not Getting Aid”

The IMF’s approach of using social spending floors in combination with targeted cash transfer programs to mitigate the impact of program adjustments did not begin with the Covid-19 pandemic. It has been a hallmark of several major programs over the past decade, including the latter part of a decade-long IMF-driven reform of Jordan’s economy. The first program, approved in 2012, removed fuel subsidies with little support to offset the increase in prices, sparking nationwide protests. According to the IMF, subsidy removal led to 5 percent inflation, yet the program did not include a social spending floor. The second program led the government in 2018 to remove bread subsidies and implement tax reforms that raised income taxes on the middle class and increased sales taxes, measures that led to inflation peaking at 5.7 percent in July 2018 and also sparked protests that culminated in the ouster of the prime minister. That program did have a social spending floor as an indicative target, but the government did not meet it in any of the program’s reviews. It provided only limited one-time subsidies to supplement Jordan’s barebones social protection system that at the time provided small amounts to certain groups of people such as orphans and older people. A government report acknowledged that investment in social assistance decreased between 2011 and 2017 despite the subsidy removal generating 788 million JD (US$1.1 billion) in savings during that time. A change in how Jordan calculates poverty in its Household Income and Expenditure Survey between 2011 and 2018 means it is not possible to compare poverty rates over this period, but an independent analysis found an increase of 8 percentage points. Following the 2018 reforms, World Bank data indicates a steady increase in food insecurity, from 12.7 percent in 2017 to 17 percent in 2020, the last year for which there is data.

In 2019, the government, working with the IMF, World Bank, and UNICEF, established a targeted cash transfer program called Takaful that was meant to protect people from the costs of these adjustments. Takaful exemplifies both the power of the IMF’s attention to social protection and the limits of its preference for targeted programs. The timing of the program’s implementation was fortuitous; the first disbursement went out just as the pandemic hit. Originally intended to reach 85,000 households, authorities were able to quickly supplement the program to reach 240,000 informal workers in 2020 (“Takaful-2”) and a total of 160,000 in 2021 (“Takaful-3”). Human Rights Watch interviewed several people who benefitted from Takaful who described how critical the assistance was for being able to pay for food and other necessities.

At the same time, the program was not sufficient to ameliorate price increases that began in 2012 and is far too narrow to ensure people’s rights. People described the challenges they had absorbing the price increases to which IMF-driven reforms contributed with little or no support. The Covid-19 expansion expired at the end of 2021, and the original Takaful was expanded to reach 120,000 beneficiary households in 2022, that amounts to around 5 percent of Jordan’s population of roughly 11 million. Since the start of the pandemic, poverty has increased from 15 to 24 percent, and even at its larger size, Takaful only reached around one in five Jordanians living under the poverty line.

To select beneficiaries, the government first vets whether applicants meet basic eligibility criteria, such as whether the head of the household is a Jordanian citizen with a national ID number. For households that make the cut, the government applies an algorithm to estimate their income based on 57 socio-economic indicators (such as household size, asset ownership, the gender of the head of household, and dwelling characteristics), ranking them from least poor to poorest. The National Aid Fund (NAF) targets cash transfers to those ranked the poorest until all program slots are taken.

Separate Human Rights Watch research published in June 2023 found that some of the indicators resulted in hairsplitting distinctions to determine who should receive benefits or reinforced discriminatory Jordanian policies. Human Rights Watch also found that the algorithm relies on inaccurate data about people’s informal sources of income and living expenses to estimate people’s income. A survey conducted by UNICEF found only marginal differences for rates of food insecurity and other measures among Takaful beneficiaries, those who are eligible but were not selected as beneficiaries, and those who applied but were deemed ineligible. Moreover, non-Jordanian households are not eligible for Takaful despite experiencing higher levels of poverty than Jordanians and families of Jordanian women married to non-Jordanian men are less likely to qualify. As a universal right, the right to social security applies to all, regardless of citizenship or immigration status, in line with the rights to equality and nondiscrimination.

Human Rights Watch spoke to several people who were rejected by Takaful despite having trouble feeding their family. Rahma, an agricultural worker with six children, told Human Rights Watch she applied twice for assistance and was rejected both times. She and her husband each earn 10 JD (US$14) for a day’s work; the minimum wage in Jordan is 260 JD ($367) per month and a living wage for a typical family, according to one calculation from 2020, is around 600 JD ($846) per month. “We’re basically starving. There was a period of time when we only had two bags of rice and we’d ration it.” People also described being increasingly unable to pay for their electricity bills. “Bassam” has seven children and his wife doesn’t work, but he was denied support because he has a restaurant registered in his name, although it has since closed down. He described his difficulty paying his electricity bills: “They cut off electricity, we go beg for money, and get it turned back on. After three months of not paying, it’s cut off. We sit in candlelight and don’t use food that needs refrigeration.” The most recent IMF program, approved in 2020, led to an overhaul of the electricity pricing system aimed at reducing costs for businesses, which had been paying higher prices to cross-subsidize household tariffs. The reforms incorporate subsidies that, at least for now, appear to protect most Jordanians from tariff increases, but some may still see their bills go up and Jordan’s large refugee population is not eligible for the subsidy.

Jordan’s experience of Takaful carries important lessons for the IMF as it replicates the approach it took there in other countries. A social spending floor, even when combined with a targeted cash transfer program, is not nearly enough to protect people from the impacts of austerity measures or to differentiate the IMF’s Covid-19 response from its previous response to crises.

Glossary

Adjustments: Changes to economic policies to which countries agree as a condition for IMF lending.

Austerity: A set of reforms within the context of a contraction of public spending in terms of GDP or in real terms.

Conditionality: Specific terms or actions which governments are required to undertake or achieve in order to receive IMF funds.

Extended Credit Facility: 3- to 5-year IMF loan program available to low-income countries, currently at zero interest.

Extended Fund Facility: 3- to 4-year IMF loan program, subject to interest and other fees.

Fiscal consolidation: Cutting public spending or increasing revenues to reduce deficits or debt.

Indicative target: Flexible quantitative indicators to monitor progress in IMF loans; does not require a waiver by the IMF Board if unmet.

Performance criteria: Specific, measurable conditions in IMF loans that borrowing governments are required to meet or obtain a waiver from the IMF Board.

Prior actions: Steps a government agrees to take before the IMF approves financing or completes a review.

Public wage bill: Total compensation to government employees, including salaries, allowances, and social security contributions.

Social assistance: A subset of social protection comprising tax-financed transfers (that is, not including programs funded through individual or employer contributions).

Social protection: A set of policies and programs aimed at preventing, protecting, and overcoming situations that adversely affect the well-being of people throughout the course of their lives.

- Poverty targeted/means-tested: Eligibility for benefits is based on falling below a certain threshold of income or assets.

- Universal: Benefits are available to everyone within specific groups that encompass stages of life or statuses in which people’s economic, social and cultural rights are particularly at risk, such as children, people with disabilities, unemployed adults, caretakers, and older people.

Social safety net: The term has no clear set definition. The ILO uses the term to describe programs meant to temporarily buffer people from economic shocks, while the World Bank typically uses it to refer to tax-financed social assistance.

Social security: Enshrined in international human rights law, a range of programs, whether funded from contributions or through general taxation, that encompass at least nine areas of support: health care, sickness, older age, unemployment, employment injury, family and child support, maternity, disability, and survivors and orphans.

Social protection floor: Nationally defined sets of basic social security guarantees codified in ILO Recommendation No. 202.

Social spending floor: In IMF programs, minimum amount of spending on specific social programs or ministries or other related measures, such as minimum number of households covered by social assistance programs.

Stand-By Arrangement: Short-term IMF loan program, typically 12-24 months but no longer than 36 months, most used by advanced and emerging market countries.

Structural benchmarks: Reform measures included in IMF programs that are not quantifiable such as enacting specific legislation or undertaking audits.

Value-added taxes: A consumption tax on goods and services that is levied at each stage of the supply chain where value is added

Recommendations

This report demonstrates the inadequacy of the IMF’s current approach to social spending floors both for addressing longstanding gaps and for offsetting the harmful impact on human rights of IMF-driven reforms. While recommendations for specific economic or fiscal reforms are beyond the scope of this report, there are a number of key actions that are critical for pursuing recoveries that advance human rights in the short and long term.

For the IMF

- Prioritize progressive revenue generation and other measures over cuts to public spending when seeking to reduce fiscal deficits and debt.

- Conduct human rights impact assessments of programs that:

- Demonstrate efforts to avoid austerity measures and establish that any such measures are temporary, necessary, proportionate, respectful of minimum core human rights obligations, and non-discriminatory.

- Calculate the expected and actual impact of program conditionalities by income decile, as well as on groups that face discrimination, in line with the 2019 social spending strategy. To ensure effective assessments, the IMF should:

- Explicitly prohibit discrimination in all its operations and seek to identify, end, and remedy any direct or indirect discriminatory impacts of its policies, including based on gender, nationality, age, disability, race or ethnicity, religion, or other grounds prohibited in international human rights law.

- Periodically review and publish assessments throughout the duration of loan programs.

- Facilitate informed and meaningful engagement with the public in countries with ongoing loan negotiations, particularly with those most likely to be harmed by program conditionalities, including by publishing impact assessments well in advance of program approval.

- Any reforms to public wage bills should ensure adequate staffing at living wages for sectors key to the fulfillment of human rights, including health and education, and consider existing national staffing shortages against international benchmarks.

- Ensure any fossil fuel subsidy reform is structured to advance the realization of people’s rights and the transition to renewable energy. This should include measures, such as expanding social protection, that are implemented prior to subsidy removal, and increased investment in renewable energy that reduces costs, particularly for people on low incomes.

- Consistently include two separate floors in loan programs: One should protect and increase spending in areas critical for fulfilling economic and social rights without discrimination and should be broadly defined, disaggregated by sector, and ensure that spending on, for example, health, education, and social protection are, at a minimum, in line with international benchmarks as a percentage of GDP and of national budgets. A second should adequately mitigate against necessary measures that nonetheless pose risk to rights, such as phasing out fossil fuel subsidies, based on published assessments of program impacts, and should demonstrate how the included measure, such as increased social protection spending or coverage, avoids, at a minimum, the retrogression of rights.

- Consider replacing “floors,” which are revised ad hoc in each review, with “goals” to be achieved by the end of the program, and a plan developed from the outset to achieve specific benchmarks in each review.

- Include baseline data for social protection and spending floors, as defined in individual programs.

- All minimum spending amounts should be included as percentage of GDP as well as in nominal terms.

- Ensure the floor specifically for social protection coverage is set high enough and appropriately defined to adequately offset adjustments and enable broad social protection programs. Specifically, develop standardized design procedures so that floors cover all elements of the ILO social protection floors recommendation and Convention 102 on minimum standards of social security.

- Formally adopt a goal of achieving universal social protection in line with the World Bank and ILO positions.

- Ensure that any reform to social security is in accordance with international labor standards and agreed by all relevant social groups through national social dialogue.

- Protect and strengthen other areas important for the fulfillment of economic and social rights, including public services; labor rights, such as freedom of association and living wage; and governments’ capacity to tackle corruption and tax evasion.

- Commit formally to recognize a duty to respect, protect and fulfil all human rights, including economic and social rights, in all its work, without discrimination.

For IMF Executive Directors

- Support guidance to expect IMF staff to conduct distributional impact analyses for all programs and include them in staff reports.

- Support a careful assessment of the impacts of the IMF’s current approach to lending and possible alternatives and publish the results of the assessment that supports an approach most effective at reducing poverty and inequality and fulfilling economic and social rights in the short- and long-term.

World Bank

- Undertake a review of projects on safety nets to assess their consistency with the World Bank’s stated position on universal social protection and with human rights standards.

- Write and approve a strategy to accelerate action to achieve universal social protection.

For Jordan and other Governments

While the report focuses on Jordan as a case study, these recommendations may apply to other governments pursuing similar economic and fiscal programs. In particular:

Social Spending and Cash Transfers

- Publicly commit to substantially scaling up social spending including on social protection to ensure the protection of the right to social security and other human rights for everyone in the country and ensure that such spending is not decreased as part of fiscal consolidation.

- Transition to universal social protection by phasing in specific groups of people to receive universal benefits, such as children, older people, people who are unemployed, and people with disabilities. During the transition period, remove discriminatory barriers to Takaful by including all residents regardless of nationality, including families of people with temporary Jordanian passports, non-citizen spouses, and children of Jordanian women.

- Ensure dedicated budget lines for both Takaful’s operations and cash transfers in the government budget.

Electricity Reform

- Publicly recognize the right of everyone in the country to affordable and accessible clean electricity.

- Conduct review of economic accessibility of consumer electricity prices and the assumption that usage accurately correlates with income. Ensure electricity remains accessible for low-income households.

- Substantially increase investment in renewable energy for low-income households and other initiatives to increase efficiency and reduce electricity costs central to any future electricity pricing reform.

- Ensure that non-Jordanian citizens, including refugees and migrant workers, have access to affordable electricity.

Progressive revenue generation

- Scale up efforts to halt corruption including by removing any barriers to investigation or prosecution.

- Invest adequate resources to investigate cases of tax evasion on the highest earners.

- Increase revenues through progressive income tax measures that ensure those with the highest income and/or wealth pay their fair share.

Labor rights

- At a minimum, refrain from weakening labor rights such as by reducing employer social security contributions for certain employees.

- Establish an hourly living wage that also extends to informal workers.

- Allow the creation of independent, elected trade unions in all trades, including domestic workers and for migrant workers, limit official involvement in the creation and management of such unions, and allow for the reinstatement of the unions that have been arbitrarily dissolved or dissolved based on abusive or overbroad provisions. Ensure full respect of freedom of association for all trade unions.

Methodology

This report analyzes the International Monetary Fund’s use of social spending floors in its loans in the wake of the Covid-19 pandemic and seeks to assess their adequacy for mitigating the impact of program reforms on people on low incomes. It situates this analysis against the backdrop of a significant evolution in the IMF’s rhetoric around poverty and inequality starting in the 1990s up to 2023, as well as its policies and guidance, that articulate an institutional goal of building more inclusive economies and reducing inequality.

The report provides an analysis of key measures, with a focus on social spending floors, in 39 loans approved between March 2020 and March 2023 under the IMF’s Extended Credit Facility, Extended Fund Facility, and Stand-By Arrangement, all of which are lending instruments that include conditionalities. This includes programs in the following countries: Afghanistan (frozen), Argentina, Armenia, Bangladesh, Barbados, Benin, Cabo Verde, Cameroon, Chad, Congo, Costa Rica, Democratic Republic of Congo, Ecuador, Egypt, Gabon, Gambia, Georgia, Guinea-Bissau, Jordan, Kenya, Madagascar, Malawi, Mauritania, Moldova, Mozambique, Nepal, Niger, Papua New Guinea, Senegal, Serbia, Seychelles, Somalia, Sri Lanka, Suriname, Tanzania, Uganda, Ukraine, and Zambia (a loan program to Ukraine approved in March 2023 is not included in this report’s analysis given the extenuating circumstances in the country at the time of approval). The analysis examines the following elements of loan agreements: fiscal consolidation; reforms to public wage bills; subsidy reforms; reforms related to value-added taxes; and references to social spending or social protection and related conditionalities.

It also provides an in-depth analysis of four IMF loan programs in Jordan starting in 2012, where social spending floors, and a related cash transfer program, were intended to offset the impact of IMF-driven fiscal policy and subsidy reforms.

In researching this report, Human Rights Watch reviewed thousands of pages of IMF loan documents, as well as numerous policies, guidance notes, research papers, and institutional reviews. For the case study on Jordan, Human Rights Watch conducted most of the interviews in person in October 2021 with 30 Jordanians (20 men and 10 women) on low incomes living in Amman, Jordan’s capital; Zarqa, a town around 30 kilometers northeast of Amman; and the southern al-Ghor, an agricultural area near the Dead Sea. Human Rights Watch conducted additional interviews with people on low incomes between November 2022 and January 2023.

In addition, Human Rights Watch interviewed representatives from Jordanian and international civil society and trade unions, IMF staff, former Jordanian government officials, relevant UN agencies, humanitarian workers in Jordan, and experts on Jordan’s economy and electricity sector. Human Rights Watch wrote to the IMF on August 9, 2023, the World Bank on July 27, 2023, and the Jordanian and Ecuadorian governments on June 18, 2023, and June 9, 2023, respectively.

In a response to Human Rights Watch’s letter, the World Bank reaffirmed its commitment “to advocate for and support the goal of universal social protection,” but noted that it supports means-testing as part of its strategy to advance toward that goal: “In budget constrained contexts, our experience shows that targeted interventions can be an effective method to distribute a limited amount of resources to those who need it most.” It also notes that while “ the World Bank does work closely with all international partners to share global understanding and best practices on the design and implementation of social protection programs, policies, and strategies,” it “does not have a formalized arrangements in the design of [IMF] programs.” Finally, it lauds Jordan’s cash transfer program as “the largest such program in the Middle East and North Africa Region (MENA) in terms of coverage of the poorest people,” and says that “the government covers this funding using the same mechanisms adopted to finance various other programs in the general budget.

On September 22, in response to Human Rights Watch’s letter, the IMF wrote: “Prioritization of social spending with a focus on supporting the most vulnerable is an important aspect of the IMF’s work and a guiding principle of our 2019 Strategy for Engagement on Social Spending.”

Human Rights Watch informed all interviewees of the purpose of the interview, its voluntary nature, and the ways in which the information would be collected and used. Human Rights Watch assured participants that they could end the interview at any time or decline to answer any questions, without any negative consequences. All interviewees provided informed consent to participate in the interviews. Human Rights Watch did not offer any remuneration. Most names have been changed to protect interviewees.

I. Background: IMF and Social Protection

As the Covid-19 virus began to spread, shuttering businesses and upending economies, the Managing Director of the International Monetary Fund, Kristalina Georgieva, saw opportunity in the recovery from the unraveling crisis. Georgieva had already identified income and wealth inequality as a central challenge facing the global economy.[1] In her view, the pandemic brought both the risk that poverty and inequality would exponentially worsen and a “once in a lifetime opportunity” to invest in recoveries that transform economies to make them “greener, smarter, and fairer.”[2]

In speeches, interviews, and opinion pieces, Georgieva laid out a strategy for how the IMF can help governments emerge from the pandemic with more inclusive and resilient economies, from modernizing tax systems to make them more progressive to investing more in health, education, restructuring unsustainable debt, and building stronger social protection systems.[3] This vision—what Georgieva called a “new Bretton Woods moment” —continues a significant evolution in how the Fund sees its role in promoting global economic stability.[4]

The IMF’s Evolving Position on Social Issues

The IMF was established in 1944 as part of the Bretton Woods Agreement, which sought to rebuild the international economic system ravaged by World War II. Its stated purpose, set out in its Articles of Agreement, is to promote international monetary cooperation and bolster the economic stability of member countries.[5] It does this primarily by making concessional loans available to governments facing balance of payment problems (that is, when public revenues fall too far below expenditures) and by issuing regular surveillance reports that assess the financial health of its members, called Article IV reports after the section in the Articles of Agreement that mandates them.

Traditionally, the Fund took a narrow view of its mandate, often invoking a clause in its Articles of Agreement stipulating that Fund guidance with respect to exchange rate policies “shall respect the domestic and social policies of members” to prevent the Fund from engaging on issues such as adequacy of social spending, corruption, and economic inequality.[6] However, this view began to gradually shift in the 1990s, a period when the Fund was heavily involved in the transition of post-Soviet states to market economies.[7] The Fund’s role in promoting “shock therapy,” particularly in Russia, was heavily criticized for removing price controls and implementing other measures in a way that has been blamed for increasing the immiseration of the population while rapid privatization through opaque and corrupt deals created a handful of oligarchs, such that by 1993 the United States formally ended its support for the approach.[8] In the mid-1990s, the managing director issued a series of memos to staff calling for broader IMF engagement in social and distributional policies.[9] At the same time, the Board adopted a number of guidelines for staff engagement on issues considered outside its traditional focus, including on poverty (1991); implications of policies on income distribution (1996); and governance (1997).[10] In 1996, the Board also approved guidelines for collaborating with the ILO on labor market and social protection issues.[11] And beginning in 1998, Article IV surveillance reports were expected to include tables with basic social data.[12]

These developments increased IMF attention to social issues in surveillance reports, the annual reports that monitor and assess a member country’s economy. However, they had limited impact on operations. A 2004 internal review of a range of IMF reports produced between 2002 and 2004 found that while half of Article IV reports included “some discussion of social issues,” references were often superficial and substantive discussions were mostly limited to “post-conflict countries and countries with endemic political and social instability.”[13] The review, referencing the Articles of Agreement clause on respecting the domestic and social policies of members, recommended staff be more selective in when they engage on social issues, to cover “fewer issues in greater depth, perhaps every few years.”[14]

Similarly, the review found that while governance was addressed in 70 percent of surveillance reports, they “tend to be limited to descriptions of facts and of the authorities’ past or current actions; they tend to stop short of assessing adequacy of these steps or needs for further action.”[15] Moreover, corruption—the underlying problem governance is meant to address—was only referenced in 10 percent of reports.[16] In other words, while staff were increasingly paying attention to issues like social protection and governance in their reports, they rarely made their way into policy prescriptions embedded in IMF programs. In response to the review, the IMF’s Board of Directors were “broadly satisfied” with how governance issues were being monitored, although some expressed support for more research and analysis on how to improve growth and resilience for low-income countries and more closely monitoring progress toward the Millennium Development Goals.[17]

The aftermath of the 2008 recession laid bare the limits of the Fund’s approach to social issues. Although during the crisis the IMF supported increased spending, including on social sectors, by 2010 that gave way to insisting that governments seeking bailouts drastically contain their debt by reducing their spending, including on programs vital to protecting people’s rights.[18] A comprehensive review of IMF programs by the ILO and Columbia University in 187 countries between 2010 and 2020 demonstrated how austerity-driven programs gutted funding for health, education, pensions, and social assistance programs, at a time when huge sectors of the population were reeling from job and income losses due to the recession.[19]

In Europe, the push for austerity, particularly in Greece, Spain, Ireland, and Portugal, where the EU also drove austerity policies, faced massive popular backlash, badly damaging the Fund’s reputation.[20] This fallout worsened when the bitter medicine the Fund had prescribed was not working to heal ailing economies. On the contrary, the economic results were often disastrous, in some cases leaving countries mired in deepening poverty and inequality.[21] In January 2013, the IMF’s chief economist, Olivier Blanchard, issued a paper that amounted to a rare acknowledgment that the Fund’s insistence on austerity was deeply flawed. The paper compared economic growth in countries where austerity was imposed to IMF projections and found that austerity had the exact opposite effect than the IMF had anticipated.[22] Remy Davison, a professor on international relations at Monash University, summed up the paper’s findings: For every dollar governments cut from public spending, the economy shrank by $1.50, whereas the Fund had predicted that for every dollar cut in government spending, economic output would only shrink by 50 cents.[23] The paper said the IMF underestimated the “fiscal multiplier effect;” the extent to which government spending effects levels of consumer spending and investment.

The IMF’s response to the recession set off a vigorous debate about its economic approach, and renewed calls, including by many IMF staff, for the need to take the social and political implications of its programs much more seriously. This was, in part, an exercise in repairing its reputation. Christine Lagarde, who was appointed managing director in 2011, made it a point to, in her words, give the IMF a “human face,” and spoke more often about issues like gender and income inequality.[24] In 2012, she gave a speech specifying “better social protection” as one way of achieving more “inclusive economies.”[25]

This shift also made its way into IMF research, guidance, and reporting. In 2012, the IMF’s internal guidance changed its definition of “macro-criticality,” meaning that it affects a country’s macroeconomic situation, which is the standard for staff to assess whether issues are within its mandate. The new definition includes any issue that “affects, or has the potential to affect, domestic (e.g., growth and inflation) or external stability.”[26]Staff maintained broad discretion over the issues they chose to work on, but this gave them a stronger basis to tackle emerging issues outside their traditional focus.

The IMF Board approved a crop of new policies and guidance notes that focused on these emerging issues. For example, in 2013, the Fund issued new guidance on jobs and growth that called for more systemic integration of policy advice to encourage, among other things, reduced inequality and better protection of the “vulnerable.”[27] A review of 2002 conditionalities the following year revised existing guidance to instruct staff that, “if feasible and appropriate, any adverse effects of program measures on the most vulnerable should be mitigated.”[28] Previously, even after establishing that there was a “strong justification” for working on issues outside the IMF’s core mandate, staff were expected to rely on the expertise of institutions such as the World Bank and had little recourse where such expertise was lacking or inadequate.[29]

In 2018, the Board approved new guidelines on social safeguards and a guidance note for improving the Fund’s engagement on governance, both of which gave staff more leeway to address social issues when designing programs.[30] The same year, IMF staff published two reports on operationalizing inequality and gender in country work.[31] In 2019, the Board approved a new strategy on social spending, which is discussed in detail in the following section.[32]

The IMF and Social Protection

Social protection is broadly recognized, including by the IMF, as key for reducing poverty and inequality.[33] This is closely linked with the human right to social security, which first appeared in the Universal Declaration of Human Rights and was later enshrined in the International Covenant on Economic, Social and Cultural Rights, ratified by 171 countries.[34] The Committee charged with monitoring the treaty’s implementation has interpreted this right to encompass nine areas of support: health care; sickness; older age; unemployment; employment injury; family and child support; maternity; disability; and survivors and orphans following the death of a breadwinner.[35]

Social protection is a less well-defined concept. The United Nations defines it as a set of policies and programs aimed at preventing, protecting, and overcoming situations that adversely affect the well-being of people, throughout their life course.[36] Most often this includes a combination of cash or in-kind (such as food) transfers distributed through contributory or non-contributory schemes.[37] This report uses the UN definition, but the term is sometimes used to encompass a broader range of public programs, including access to essential health care and education, as well as subsidies that reduce costs such as for fuel, electricity, or food. For example, in 2012, the ILO adopted a recommendation on Social Protection Floors (No. 202), described in detail below, that include universal access to health care and basic income security; it should be noted that these floors are distinct from IMF social spending floors.

Target 1.3 of the Sustainable Development Goals (SDGs) calls on countries to “implement nationally appropriate social protection systems for all, including floors, and by 2030 achieve substantial coverage of the poor and the vulnerable.” The IMF’s approach to social protection is less categorical. On the one hand, it has increasingly emphasized the importance of social protection over the past decade, reflecting its broader evolution on social issues.[38] Following its 2019 social spending strategy, it developed a Technical Note on social safety nets, which are the central focus of its emphasis on social protection.[39] The focus on social safety nets already reduces social protection to what are generally poverty-targeted programs, which the Note defines as typically “noncontributory transfer programs designed to protect households from poverty and destitution by ensuring some minimum level of economic well-being.”[40] It expects that IMF engagement on safety nets “is likely to continue to expand as member countries respond to a rapidly changing economic and fiscal landscape.”[41] At the same time, it has maintained some distance from the idea that social protection falls within its remit, and frequently emphasizes its limited expertise on these issues. For example, both the 2019 strategy and the Technical Note instruct staff to rely on development institutions’ expertise and the World Bank in particular.[42]

However, even where other institutions or governments design social protection programs, the Fund exercises enormous influence over governments’ capacity to invest in such protection, such as by setting fiscal consolidation (that is, revenue increases or spending restraints for debt and deficit reduction) targets and social spending floors. While these floors, which are described further below, are not meant to be the maximum amount a government can spend, in practice the fiscal targets leave governments little flexibility to spend more. A review by Oxfam of 15 loans approved in 2020 and 2021 found that nine governments’ actual spending was within 10 percent of the cumulative floor and four spent less than the floor.[43] Moreover, many IMF-mandated reforms directly impact programs that function to reduce poverty and inequality, such as reducing or eliminating subsidies, pension reform, and freezing or reducing public sector jobs or salaries.[44] It often explicitly relies on a combination of social spending floors and specific improvements in social protection programs—typically establishing or expanding targeted cash transfer programs—to “mitigate” the impacts of these measures. For example, in Egypt, where IMF programs led to removal of fuel subsidies and other major changes in economic policy, the staff report notes that, “To mitigate the impact of the reforms on the poor, the authorities intend to use part of the fiscal savings to strengthen the social safety nets,” including two World Bank-funded targeted cash transfer programs.[45]

In addition, the IMF’s suggestion that its staff should rely on the World Bank’s expertise on social protection is in tension with its own resistance to following the Bank’s lead in embracing, at least in principle, universal social protection over targeted schemes.[46] While the Bank is far from implementing this commitment in practice, the Fund, as detailed below, has not taken the step of making universal social protection a goal and continues to be an active champion of targeted social assistance.[47] In some cases, the Fund explicitly calls on governments to more narrowly target its social assistance, but even where it does not, its position has important implications for where it sets social protection floors.[48]

Targeted versus Universal Social Protection

There are diverging views as to whether social protection programs should be universal (also called categorical), which is to say accessible to an entire population or specific categories of people (for example, children, older people, or people with disabilities) regardless of economic status, or whether it should be targeted based on people’s income, assets or other criteria such as the type of housing they live in (that is, means-tested). The IMF has largely promoted means-testing and in some countries, it has explicitly called for replacing universal programs with targeted ones.[49]

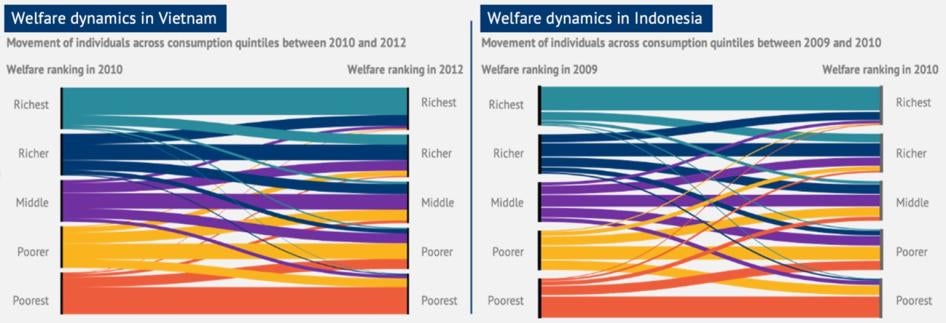

The appeal of a targeted approach seems intuitive: in a context where resources are limited, directing funds to those most in need appears to make sense. However, under human rights law, all people have the right to social security. Moreover, there is a robust body of research documenting that targeted programs, as a result of both their design and implementation, are expensive, prone to errors, can exacerbate social divisions and mistrust in government, and fail to adequately protect rights.[50] A 2017 study by the ILO and Development Pathways, a consultancy group that supports social protection systems in developing countries, found that targeting methodologies often result in errors due to both their design and implementation. For instance, targeting often relies on dated surveys, despite the reality that household composition, income, and needs are highly dynamic.[51] It also found that targeting that leads to arbitrary exclusion can generate social conflict and divisions within communities.

In recent years, a range of international voices, including the ILO and World Bank, have embraced universal schemes. In 2015, the World Bank announced it would partner with the ILO to promote universal social protection and in 2019 it published a white paper, Protecting All, that “wholly endorses the objective of universal social protection espoused by the international development community.”[52] The World Bank also joined numerous bodies, including the African Union and European Union, to form USP 2030, an initiative it co-chairs to achieve universal social protection by 2030.[53] Recognizing resource constraints, some economists, including in the 2019 World Bank white paper, have advocated for “progressive universalism,” wherein states begin by supporting the poorest segment of the population and gradually expand the program to include all. While a large gap between the World Bank’s position and its project designs remains, the Bank’s rhetorical embrace of universal social protection is significant.

The IMF, in contrast, has remained wary about universal social protection even as it recognizes, particularly in recent years, the shift in international consensus. For example, in December 2018, the IMF’s Finance & Development Magazine published several articles that strongly argued for the IMF to embrace universal social protection in line with emerging economic research and international practice.[54]

More significantly, in a new strategy on social spending approved in 2019, discussed more below, the IMF Board sought to clarify its position on targeted and universal schemes. The strategy acknowledges that in the majority of cases, mission chiefs recommend means-tested social protection, and in nearly one in five cases they recommend downsizing programs that are not means-tested.[55]

At the same time, recognizing the ILO and World Bank’s position on universal protection, as well as the approach of progressive universalism, the strategy asks mission chiefs to take a flexible approach, taking into consideration “country preferences and circumstances, including administrative, financing, social, and political constraints.”[56] While this opens the door to more frequently pursuing a universal approach, the language is cautious and doesn’t explicitly question mission chiefs’ overwhelming preference for targeted schemes to date.[57] Moreover, the Technical Note on social safety nets appears to double down on targeting and explicitly favors conditional cash transfers over other forms of social protection.[58] Although, like the social spending strategy, it directs staff to take into consideration “government objectives” when determining whether to target, and heavily emphasizes safety nets as a tool for reducing poverty.[59] In such cases, it recommends limiting transfers to only those living under the poverty line in amounts that fill the gap between household income and the poverty line, an approach that is reflected in several recent IMF programs that rely heavily on targeted cash transfer programs to mitigate the impact of IMF-driven reforms.[60] Any transfers to households whose income is above the poverty line, or amounts beyond what is needed to support households to reach the poverty line, are considered inefficient “leakage.”

At the same time, the note acknowledges many of the well-known problems with targeting. It highlights, for example, the risk of exclusion errors, noting that the “the capacity to effectively verify and monitor beneficiary incomes and other eligibility criteria … can be especially demanding in low-income settings where, for example, informal employment is prevalent and population registries are weak.”[61] It also acknowledges that “innovative approaches that rely on new technologies” could have “important trade-offs,” allowing for faster expansion though information they rely on may be “less accurate.” One way to address these challenges the note proposes is, rather than focusing on targeting the benefits, to “enhance tax capacity and effort” to “claw back” some of the benefits that accrue to high-income households.

Social Protection Floors

The 2009 G-20, meeting under the long shadow of the 2008 Financial Recession in Pittsburgh, Pennsylvania, marked an advance for international recognition of the importance of social protection. The concluding statement of labor and employment ministers recognized that their countries have a “shared responsibility” to “where needed, improve social safety nets,” and directed ministers to review reports from the ILO and other organizations to determine whether further measures were needed to address the job crisis, including “related to social protection programs.”[62] Building on this momentum, countries requested the ILO to find a common position agreeable to all governments, federated workers, and employers during its June 2011 conference calling on states to establish social protection floors with a goal of providing “universal coverage of at least minimal levels of protection.”[63] This call for social protection floors, echoed by others, was endorsed by the G-20 the same year, which defined it as “comprising a basic set of social guarantees for all and the gradual implementation of higher standards.”[64]

In 2012, delegates representing governments, workers, and employers at the International Labour Conference approved Recommendation 202 on Social Protection Floors, a new international labor standard that calls on member states to establish social protection floors, based on the principle of universality, that guarantee access to health care and provide basic income security for children; sickness, disability, or unemployment; and older persons.[65] As part of the UN Sustainable Development Goals (SDGs), adopted in 2015, countries committed to implementing nationally appropriate social protection systems for all, including social protection floors to reduce and prevent poverty.

|

IMF Conditionalities: Quantitative Performance Criteria (QPC), also simply referred to as performance criteria (PC): Specific, measurable conditions for IMF lending that require an IMF Board waiver if unmet. Many are quantatita. Indicative Targets (IT): Flexible numerical trackers for quantitative indicators to help monitor progress in meeting a program’s objectives. Structural Benchmarks (SB): reform measures that often cannot be quantified but are used as markers to assess program implementation: steps a country agrees to take before the IMF approves financing or completes a review. |

Around this time, the IMF began to integrate social spending floors into its lending; a concept distinct from social protection floors defined differently in each program but frequently encompassing a broad range of public spending. In 2009, it introduced the Poverty Reduction and Growth Trust (PRGT), a facility for low-income countries that focuses more attention on social and other priority spending, including through incorporating explicit “targets” (typically social spending floors) into program design.[66] These targets, also called quantitative conditionalities, specify an amount of spending, either nominal or relative to an indicator such as GDP. They are incorporated into programs either as Performance Criteria (PC), which require a Board-approved waiver if not met in order to receive additional tranches of funding, or as indicative targets (IT), which staff have discretion to waive if unmet.[67]